Can Prisoners Access Their Bank Accounts in the UK?

Can Prisoners Access Their Bank Accounts in the UK?

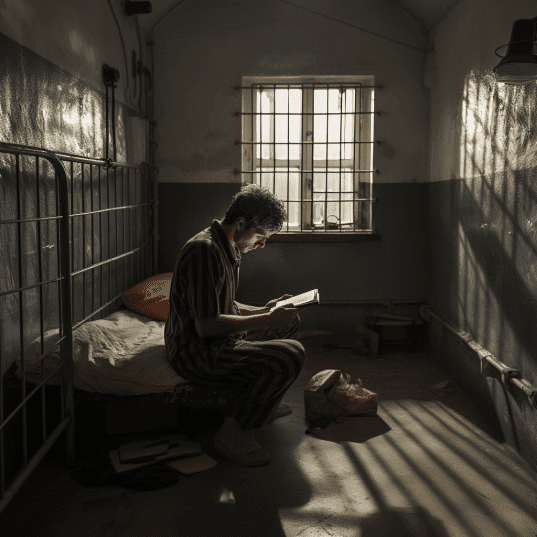

Introduction A common question regarding the rights of inmates in the UK is whether they have access to their personal bank accounts while serving a prison sentence. This article addresses the policies and practices related to prisoners’ access to their bank accounts in the UK.

Understanding Financial Rights of Prisoners

Basic Financial Rights While prisoners lose certain freedoms, they retain basic financial rights. However, their ability to directly access and manage personal bank accounts is limited.

Controlled Financial Transactions For security and regulatory reasons, prisoners’ financial transactions are tightly controlled and monitored within the prison system.

Direct Access Restrictions Direct access to personal bank accounts is generally not allowed for inmates. This restriction is in place to prevent financial crimes and manage security within the prison.

Limited Access for Specific Purposes In certain circumstances, such as preparing for release or paying for legal services, inmates may be granted limited access to their bank accounts under supervision.

Managing Financial Obligations from Prison

Payment of Bills and Obligations Prisoners are encouraged to manage their financial obligations, like bills and child support. This often involves coordinating with a designated family member or using prison-approved methods.

Support from Prison Staff Prison staff can provide assistance in managing critical financial matters, ensuring that inmates can fulfill their financial responsibilities.

Financial Transactions Through the Prisoner Account System

Prisoner Spend Account Inmates are provided with a prisoner spend account in the prison. This account is used for purchasing items in the prison canteen and for other approved expenses.

Transferring Money to Prison Accounts Family and friends can deposit money into a prisoner’s spend account. However, these transactions are subject to security checks and limits.

The Role of External Banking Services

Collaboration with Banking Institutions Some prisons collaborate with banking institutions to provide financial services to inmates, focusing on managing their finances while incarcerated.

Financial Education and Support Financial education programs are sometimes available to help inmates manage their finances effectively and plan for their future post-release.

Procedures for High-Value Transactions

Approval for Large Transactions For significant financial needs, like legal fees or debt settlements, inmates may seek special permission to carry out high-value transactions.

Monitoring and Verification Such transactions are closely monitored and subject to stringent verification processes to ensure they comply with legal and regulatory standards.

Preparing for Release: Financial Planning

Access to Bank Accounts upon Release As inmates approach their release date, they are gradually provided with more access to their bank accounts to prepare for reintegration into society.

Financial Planning Services Prisons often provide financial planning services to help inmates set up their post-release finances, including accessing pensions, benefits, and savings.

The Impact of Incarceration on Credit and Banking

Credit Scores and Banking History Long-term incarceration can impact an inmate’s credit score and banking history. Prisons and external agencies offer advice on how to manage and mitigate these effects.

Conclusion

In UK prisons, while direct access to personal bank accounts is restricted, there are systems in place to ensure that inmates can manage their financial obligations and prepare for life after release. The approach balances the need for security within the prison with the financial rights and responsibilities of the inmates, providing avenues for financial management and planning, both during incarceration and in preparation for reintegration into society.